What is a value-added tax (VAT)

What is value-added tax (VAT)? The term value-added tax refers to a consumption tax on goods and services

levied at each stage of the supply chain where value is added. such, a VAT is added from the initial production

of goods and services to the point of sale. The amount of VAT the user pays is based on the cost of the production

minus Value-added tax rates vary. Not all countries have any cost of materials that were taxed at a previous stage.

Key Takeaways

- Value-added tax is added to a product at every point of the supply chain where value is added to it.

- Advocates claim that VATs raise government revenues without punishing the wealthy by charging them more

through an income tax.

- VAT critics say the tax places an undue economic burden on lower-income taxpayers.

- The U.S. does not have VAT even though many industrialized countries do

Understanding VATs

A tax that is applied at each stage of the supply chain is known as a value-added tax.Usually, the consumer or

end user pays the tax.Its foundation is consumption, not income. VAT is charged uniformly on all purchases,

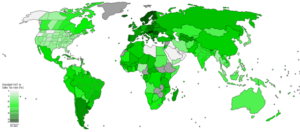

in contrast to a progressive income tax that imposes higher taxes on the wealthy.The VAT system is used in

over 160 nations.The European Union has the highest prevalence of it.VAT is levied on the gross margin at

each point in the process of manufacturing, distributing, and selling an item. The tax is assessed and collected at each stage.

Proponents claim that the VAT increases government revenue without imposing additional income taxes on the wealthy.

It is also considered more simple and standardized than a traditional sales tax, with fewer compliance issues. Critics

, on the other hand, argue that VAT is a regressive tax that places an undue economic burden on lower-income consumers

while increasing the bureaucratic burden on businesses.

VAT Taxes By Country

History of value-added taxes

The idea of value-added tax was largely a European creation.Z introduced by French tax authority Maurice Laure in 1954, although the idea of taxing each stage of the production processcentury earlier in Germany.

The vast majority of industrialized countries that make up the Organization for Economic Co-operation and Development have a VAT system. The United States remains a notable exception.

According to an International Monetary Fund study, any nation that switches to VAT initially feels the negative impacts of reduced tax revenues. In the long run, however, their study concludes that VAT adoption has in the majority of cases increased government revenue and proved effective.Vat has a negative connotation in parts of the world, even hunting its proponents politically.

Advantages and disadvantages of VATs

Advantages

-

- A VAT is close Tax loopholes: Proponents argue that a VAT would not only greatly simplify the complex federal tax code and increase the efficiency of the Internal Revenue Service. but also make it much more difficult to avoid paying taxes .Avat would collect revenue on all goods sold in the United States, including online purchases.

- VATs provide incentive earn: If a VAT supplants U.S. income tax, it eliminates the disincentive to succeed complaint levied against progressive tax systems: Citizens get to keep more of the money that they make taxed purchasing goods; this change not only confers a strong frivolous spending incentive to earn; it also encourages saving and discourages frivolous spending.

- May provide a stable source of revenue: adding VAT to tax collection provides the government with a steady revenue stream. This also ensures a stable source of revenue, as it is based on consumption rather than income.

Disadvantages

- The cost of doing business may rise because of VAT, calculated at every step of the sale process. Bookkeeping along the way results in a bigger burden for a company, which then passes on the additional cost to the consumer . It becomes more complex when transactions are not notbonly local but also international. Different countries may have different interpretations of how to calculate tax. This not only adds another layer to bureaucracy but also can result in unnecessary transaction delays.

- May encourage tax evasion: Though a VAT system may be simpler to maintain, it is costlier to implement. Tax evasion can cripple countries and even become widespread if the general public does not give it wholehearted support. Smaller businesses, in particular, can evade paying vat asking their customers if they require a receipt, adding that the price of the product or service purchased is lower if no official receipts is issue

- Conflict between local government and state: In United States, a federal Vat could also created conflict with state and local governments across the country, which currently set their own sale taxes

- May lead to higher prices: Critics note that consumers typically wind up paying higher prices for goods and services with a VAT. Though the VAT theoretically spreads the tax burden on value of goods as it moves through the supply chain from raw material to finished product, in practice, the increased typically passed along to the consumer.

The Bottom line

A value-added tax is a common form of consumption tax that is due at every stage of a product’s production,

from the sale of the raw material to its final purchase by a consumer. More than 170 countries worldwide,

including all of the countries in the European Union, levy a VAT on goods and services. This system differs

from country to country and from sales tax, found in. United States, in that a sales tax ispaid

once by the consumer at the point of sale.