Economic Consequences of Interest-Based Financial SystemInterest is prohibited in all monotheist religions.

Apart from religion, interest is also regarded as an unjustprice of money capital by pioneer secular philosophers as:

well as some renowned economists. However, it is Economic Consequences of Interest-Based Financial System

argued by some economists that modern-day, market-driven interest rates in a competitive financial intermediation

have served a useful purpose in the allocation of resources as well as in the allocation of risk, given the interpersonal

differences in risk preference that exist in any society . Economic Consequences of Interest-Based Financial SystemHence there is a need to delineate clearly whether Islamic.Economic Consequences of Interest-Based Financial System

economics distinguishes between usury and interest. Secondly, there is also a need to reassess the economic merits

and demerits of modern-day competitive financial markets fueled by interest-based financial intermediation.

Capitalism view

Capitalism, the way it is practiced as an economic system, has largely allowed and provided legal cover to

certain exploitative institutions and their operations based on free market philosophy. Such institutions

have been chiefly responsible for much of the distribution inequality in the world today

Interest-Based Financial System

Interest-based financial systems have resulted in increased concentration of wealth in the world. To put the

matters in the right perspective, income inequality, even in OECD countries, is at its highest level for the past

half-century. The average income of the richest 10% of the population is about nine times that of the poorest

10% across the OECD, up from seven times 25 years ago. OECD countries represent the developed world with sophisticated financial markets.

Income Inequality in Developed Countries

High income inequality in OECD countries shows that the more sophisticated the interest-based financial

system, the more disturbed the income distribution will be, and as various reports suggest, high economic

growth, even in the long term, does not and has not improved income distribution and rather has worsened it.

Past growth experience in Japan and the USA or even recent growth experience in India and China has resulted

in increased income distribution, but when it is obtained in the presence of an interest-based financial system,

the income distribution has worsened, as the empirical evidence shows for these countries.

Indeed, even in free market philosophy, we do not allow certain institutions that bring harm to society and individual liberty. But so far we have turned limited attention towards critically evaluating the even more intricate system of interest-based financial intermediation in practice today and its negative externalities, including pecuniary and otherwise. Economic Consequences of Interest-Based Financial System

Misallocation Of Capital

Having perfect markets leads to efficiency and economic welfare, but the institution of interest hampers potential investment by arbitrarily making capital scarce. It encourages the concentration of welfare of wealth and creates a barrier in the way of the use of funds in productive enterprises. Positive economics says that given an interest-based investment opportunity, consider only productive enterprises if the rate of return exceeds the market interest rate, but positive economics does not consider the negative externalities, e.g., increased income inequality, poverty, and below full employment use of real scarce resources resulting from artificially making capital scarce.

No matter what the initial distribution of wealth in society is, interest-based financial intermediation brings concentration of wealth eventually in every society by granting private rights of fiat money creation to central banks and allowing a fractional reserve system, which gives private banks the right to create credit money.

Furthermore, in terms of economic organization, an interest-based system also decreases competitiveness in the markets, resulting in the loss of welfare, allocation, and productivity efficiency and by creating other ills associated with market imperfection.

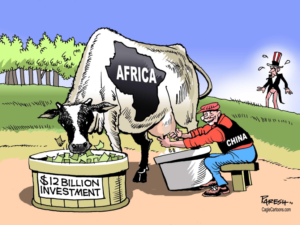

Case Studies: Africa, Zimbabwe, Nigeria, Pakistan, and Turkey

Most developing countries are going through a perpetual debt trap, which takes away resources that could have been used on development but instead are used ti service compounded debt.

More money goes out in debt servicing than what comes in as aid in many countries. On a net basis, even after receiving aid, outflow is more than inflow. If this trend persists in the future, one can see how it will perpetuate the debt trap.

The UN predicts that the coronavirus could add an additional 29 million people to the more than 400 million Africans living in extreme poverty. Progress on debt relief is slow as private lenders fear a reaction to their portfolio performance and ratings.

Evidence of Debt’s Negative Impact on Growth

There is some empirical literature that supports the negative effect of external debt servicing on economic growth and development. Easterly presented, of debt relief is heavily indebted poor countries become more heavily indebted after two decades of debt relief efforts. He states that even concessional financing-a form of debt relief-also failed to reduce the net present value of debt. According to him, the record is not encouraging for the success of current debt relief efforts.

1. Africa & Zimbabwe

From Africa, Fosu finds that the implied debt service burden adversely affects the share of public spending in the social sector, with similar impacts on education and health. Zimbabwe finds that external debt infant mortality rates.

2. Nigeria

Furthermore, Adegbite et al. confirm the negative impact of debt on growth in Nigeria. Non-linearity: Their results show that external debt may have a positive impact for some sometime,but as debt servicing increases beyond a threshold point, it starts to negatively affect the economic debt and require more resources to sustain their economics. Thus, they fall into a debt trap and find it immensely difficult to get . Ajayi and Oke found in an empirical study for Nigeria that external debt burden had an adverse effect on the per capita income and led to devaluation of the currency, increases in unemployment, social strife, and a poor educational system.

3. Pakistan & Turkey

Cunningham, collecting evidence for the period 1971-1987 from 16 HIPCs, found a significant negative relationship between the growth of debt burden and economic growth in these countries. It is not just Africa that is suffering from the debt crisis. Other developing regions are also having the same negative impacts. Malik et al. provide the empirical evidence for Pakistan’s economy, which shows a negative effect and significant relationship of external debt with economic growth. Currently, Pakistan pays around half of its tax revenues in debt servicing. To give another final account of the negative effects of interest-based debt, Karagol shows that even a relatively developed economy like Turkey has experienced negative effects of external debt servicing on economic growth.